1. Ye(ezy)

In Q1 of 2025, the Yeezy brand—once a cultural juggernaut—entered a full-blown identity crisis. What began as a creative powerhouse has unraveled into a cautionary tale. With Ye (formerly Kanye West) at the center of it all, Yeezy’s collapse is less about one misstep and more about what happens when controversy becomes your core product.

The Revenue Drop That Shook the Streetwear Throne

Just three years ago, Yeezy was riding high—pulling in $1.7 billion in both 2020 and 2021. By 2023, that number shrunk to $565 million. That’s not a dip; that’s a $2.2 billion collapse in annual revenue, punctuated by missed launches, fractured partnerships, and vanishing consumer trust.

The Adidas split in October 2022 was the beginning of the end. After Ye’s public outbursts, Adidas pulled the plug, leaving €500 million in unsold Yeezy inventory. They salvaged what they could—moving €750 million in 2023 and €250 million more in 2024. But with no new product line to follow, Adidas took a 7% sales hit in North America. Yeezy was the engine. Without it, things slowed down.

The Legal Luggage Keeps Coming

While the corporate breakup was resolved quietly in late 2024—no money exchanged—Ye’s personal legal battles haven’t slowed. In January 2025, former assistant Lauren Pisciotta filed a lawsuit alleging sexual harassment, breach of contract, and wrongful termination. A month later, a former Jewish employee came forward with accusations of antisemitic comments and retaliation. Ye hasn’t responded publicly. He hasn’t even shown up. His legal team is dodging subpoenas while plaintiffs are resorting to alternate service methods. It’s chaos in a suit and tie.

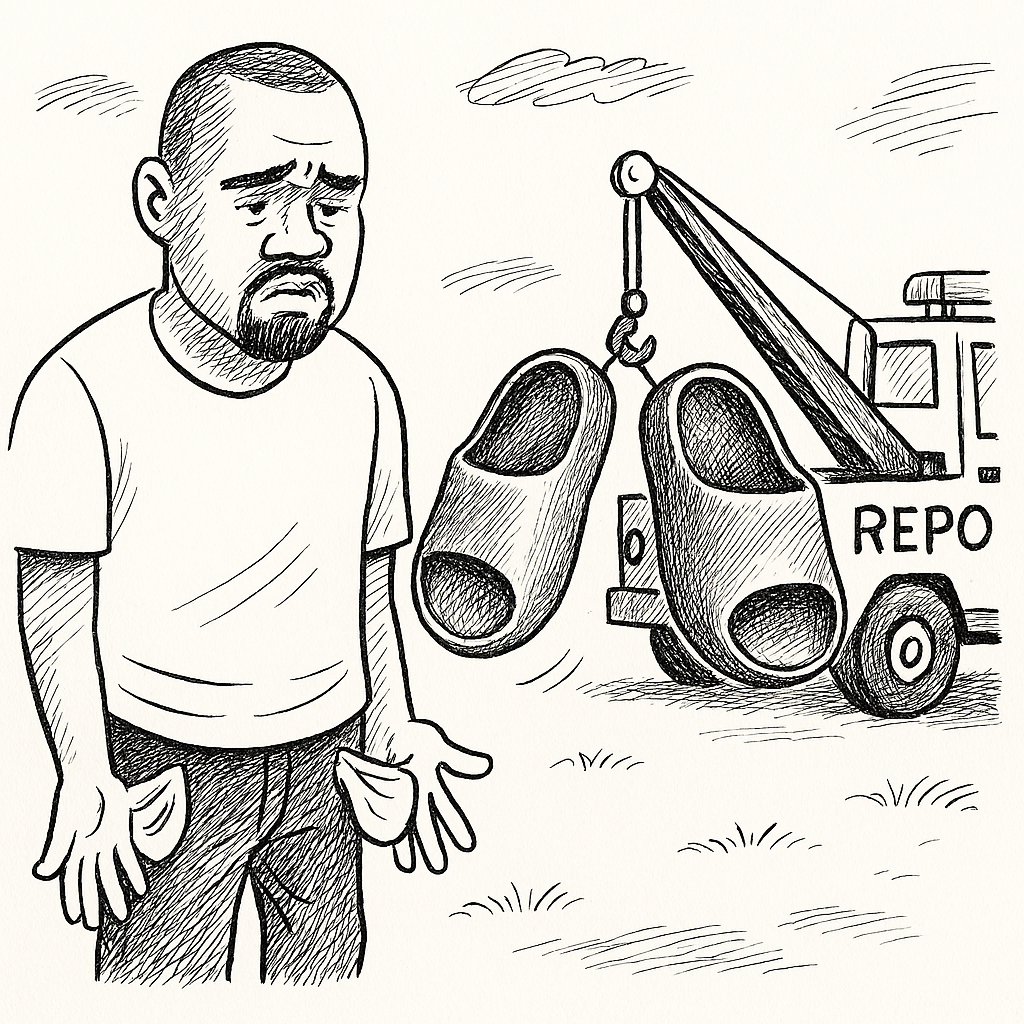

Distribution Collapse: When Even Shopify Walks Away

Retailers once eager to showcase Yeezy have backed away. And in a defining blow, Shopify—one of the few remaining platforms still hosting Yeezy products—shut down the brand’s online store in February 2025, citing policy violations tied to Nazi-associated messaging and hate speech. That wasn’t just a hit to revenue—it was a public disavowal. With Adidas gone and Shopify out, Yeezy’s distribution pipeline is now practically non-existent.

Inside the Collapse: Hiring Freezes, Layoffs, and Low Morale

Behind closed doors, Yeezy’s workforce is feeling it too. Hiring freezes are in place. Layoffs are underway. And for a company that once attracted top-tier talent with the promise of being part of something legendary, the energy has shifted. Without a clear vision, a stable leader, or product momentum, internal morale is circling the drain.

Public Perception: From Revolutionary to Risky

At one point, Yeezy wasn’t just a brand—it was a movement. Now, it’s a risk. Consumers are wary. Partners are cautious. And the cultural tide has moved on. Rebuilding won’t be easy, and the road back starts with more than a clever drop or limited release. It starts with accountability, reinvention, and a public willing to care again.

The Bottom Line

Yeezy’s Q1 2025 isn’t a rough patch—it's unraveling. Financial loss. Legal heat. Internal instability. Public backlash. Distribution blackouts. What once was aspirational now feels avoidable. And unless Ye and the brand course-correct with purpose and precision, the next chapter might read more like an obituary than a comeback.

All hope isn’t lost yet, as there are ways of countering even this level of damage. Find the solutions to these major issues below.